25 Money-Saving ATM and Credit Card Tips for Europe

Traveling through Europe is a dream—until you check your bank statement and realize you’ve been bleeding money on fees and bad exchange rates. I’ve been there, cringing at surprise charges that could’ve easily been avoided. But after 15 years of solo travel, I’ve learned a thing or two about keeping more euros in my pocket. Ready to travel smarter? Here are 25 money-saving ATM and credit card tips that’ll make your European adventure a little friendlier to your wallet.

1. Use ATMs Strategically

Avoid using ATMs at airports or tourist hotspots—they often have the worst fees and exchange rates. Find ATMs connected to reputable banks instead.

2. Withdraw Larger Amounts

ATM fees can add up, so it’s smarter to withdraw larger sums less frequently rather than small amounts often.

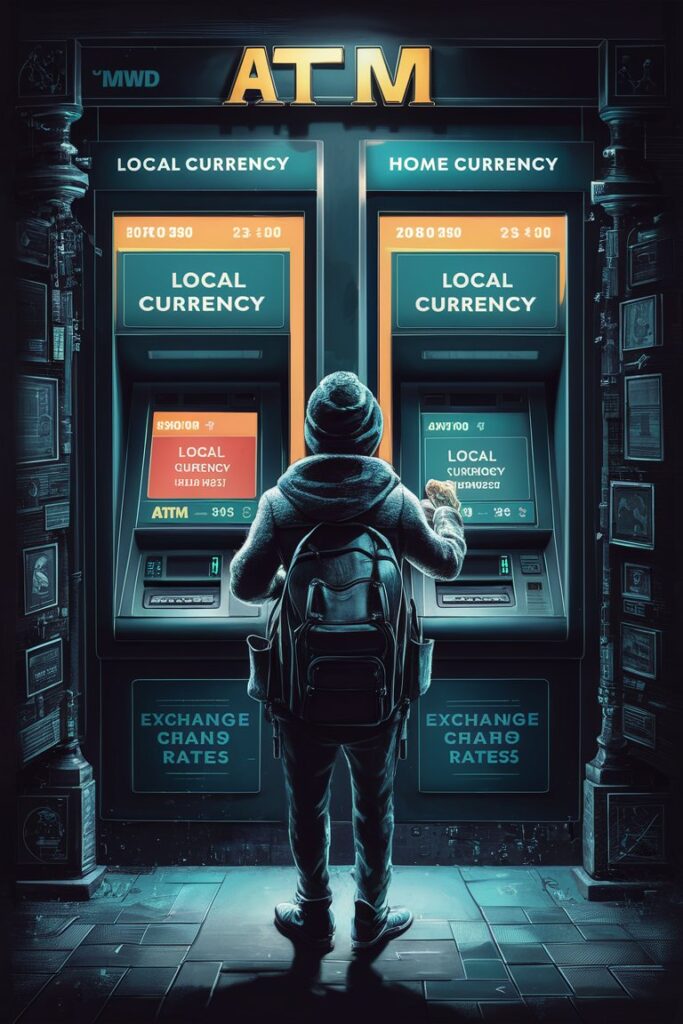

3. Opt for Local Currency at ATMs

Always choose to withdraw in the local currency instead of your home currency. Let your bank handle the conversion; ATMs will often give you a worse rate.

4. Check for Partner Banks

Many banks have international partners in Europe that waive ATM fees. Check with your bank before you go.

5. Avoid Euronet ATMs

These independent ATMs are everywhere in Europe but charge high fees and offer terrible rates. Stick to local bank ATMs.

6. Avoid Dynamic Currency Conversion

When a payment terminal asks if you want to pay in your home currency, always decline. Paying in local currency gives you a better exchange rate.

7. Notify Your Bank Before Traveling

Give your bank a heads-up about your travel plans to avoid having your card blocked for suspicious activity.

8. Set Up Travel Alerts

Use your banking app to set up travel alerts. Some banks now offer real-time notifications for purchases, helping you catch any suspicious charges.

9. Carry Multiple Cards

Don’t rely on just one card. Bring a backup credit or debit card in case of loss or theft.

10. Use Credit Cards for Big Purchases

Credit cards often offer better fraud protection and exchange rates than debit cards. Save them for hotels, flights, and big purchases.

11. Look for No Foreign Transaction Fee Credit Cards

Some credit cards charge up to 3% on every foreign purchase. Choose a card that doesn’t.

12. Enable Contactless Payments

Many places in Europe prefer contactless payments. Make sure your cards and devices are set up for this.

13. Download Your Bank’s Mobile App

Having your bank’s app lets you monitor spending, lock lost cards, and transfer money on the go.

14. Use Prepaid Travel Cards Wisely

Prepaid travel cards can be useful, but watch out for loading fees and poor exchange rates.

15. Get a Fee-Free Debit Card

Sign up for a debit card that doesn’t charge foreign transaction or ATM fees. It’s a game-changer!

16. Split Payments with Friends Using Apps

Apps like Revolut, Splitwise, or PayPal make it easy to split bills without losing money on fees.

17. Use Currency Exchange Apps

Apps like XE Currency give you real-time exchange rates, helping you avoid bad conversion deals.

18. Set a Daily Spending Limit

Setting a daily budget helps avoid unnecessary splurges and keeps your bank account in check.

19. Pay in Cash at Markets and Small Shops

Many local markets and small vendors prefer cash, and you’ll avoid credit card fees.

20. Be Aware of Credit Card Holds

Hotels and car rentals often place holds on credit cards. Keep this in mind to avoid maxing out your limit.

21. Watch for International Transaction Fees on Digital Wallets

Apple Pay and Google Pay are super handy, but check if your card charges foreign fees even through these platforms.

22. Use Banks Over Currency Exchange Booths

Currency exchange kiosks are convenient but offer worse rates than ATMs or banks.

23. Sign Up for Travel Rewards Cards

Travel credit cards can earn you points, miles, or cash back on purchases you’re making anyway.

24. Turn Off Auto Currency Conversion Online

When booking hotels or flights online, always choose to pay in the local currency to avoid hidden fees.

25. Keep Emergency Cash Hidden

Always stash a bit of emergency cash in a secure spot—just in case your cards fail you.

Traveling through Europe doesn’t have to drain your bank account. With a few smart moves and a little preparation, you can dodge unnecessary fees and make every euro count. Got your own money-saving hacks? Share them in the comments—I’d love to hear what works for you!